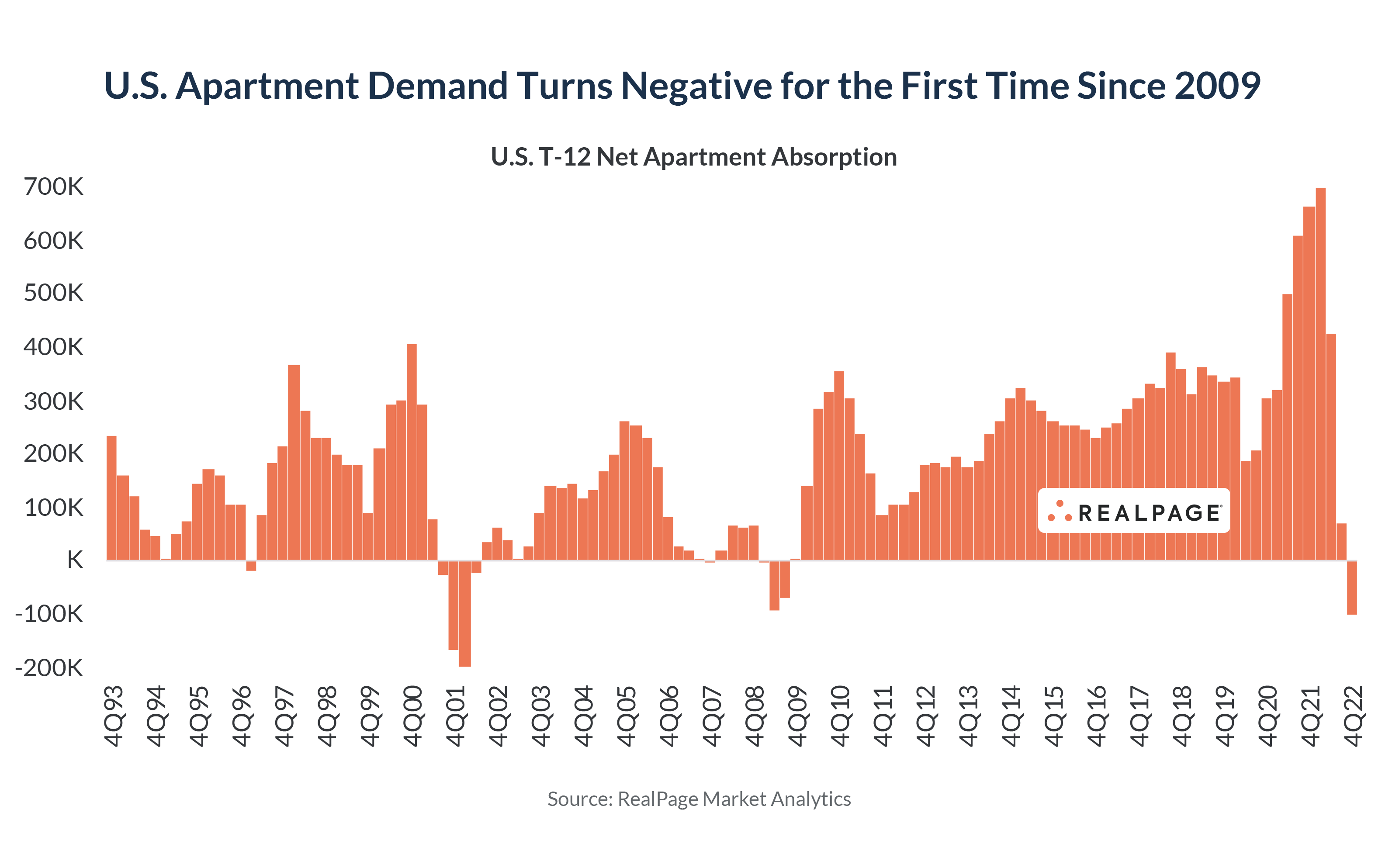

Net demand for apartments ended in negative territory for calendar 2022. But, unlike the last time demand went negative in 2009, renter turnover was curiously low in 2022. Instead, the problem was at the front door: Demand for new leases all but evaporated due to low consumer confidence and high inflation.

In other words: After an historic wave of household formation and relocations in 2021, Americans chose to mostly stay put in 2022.

We’ve never before seen a period like this – weak demand for all types of housing despite robust job growth and sizable wage gains. It wasn’t just apartment demand that shot up in 2021 and plunged in 2022. The same pattern played out to varying degrees in other rentals and in for-sale homes.

To address some common myths we hear about weak rental demand:

1. No, there’s no massive wave of move-outs. Renter turnover throughout 2022 held at historically low levels – topped only by 2021. Turnover is gradually normalizing, but it’s still low.

2. No, there’s no big jump in unpaid rent. In November 2022 (the most recent available period), 95.7% of market-rate apartment renters paid rent on time. That was up 0.6 percentage points year-over-year.

3. No, there’s no indication renters are doubling up to any significant degree. That may occur later, but as the publicly traded apartment REITs all reported in their last earnings call, it’s not a major factor yet.

4. No, there’s no “flight to affordability” – meaning renters aren’t moving down from more expensive units or markets into more affordable units or markets. The drop in demand came across all price points and in essentially all markets.

So what, then, is the issue?

The root challenge is simple: Consumer confidence in low. According to the University of Michigan’s consumer sentiment index, confidence dropped even lower in 2022 than it did during the Great Financial Crisis. Human nature is that uncertainty has a freezing effect. When you’re uncertain, you’re much more likely to stay put.

We saw this in the 2022 apartment demand numbers very clearly. We typically see a huge seasonal bounce in demand after college graduations during the summer. But that didn’t happen in 2022. Why? Well, we know from employment data that most found jobs. So why didn’t they show up in the housing market? It appears many got jobs but chose to live with family or friends given economic uncertainty and inflation – including elevated housing costs.

That would point to pent-up demand for apartments in 2023. But first we need to see consumer confidence rebound. That is no sure thing, especially with more voices predicting a pending recession. But cooling inflation (including a string of rent cuts) could be a strong enough counter measure to unleash stronger apartment demand in 2023 than we saw in 2022. That appears likely to happen, even if the Consumer Price Index doesn’t capture it right away due to a lagged methodology.

Rental Market is Shifting in Favor of Renters

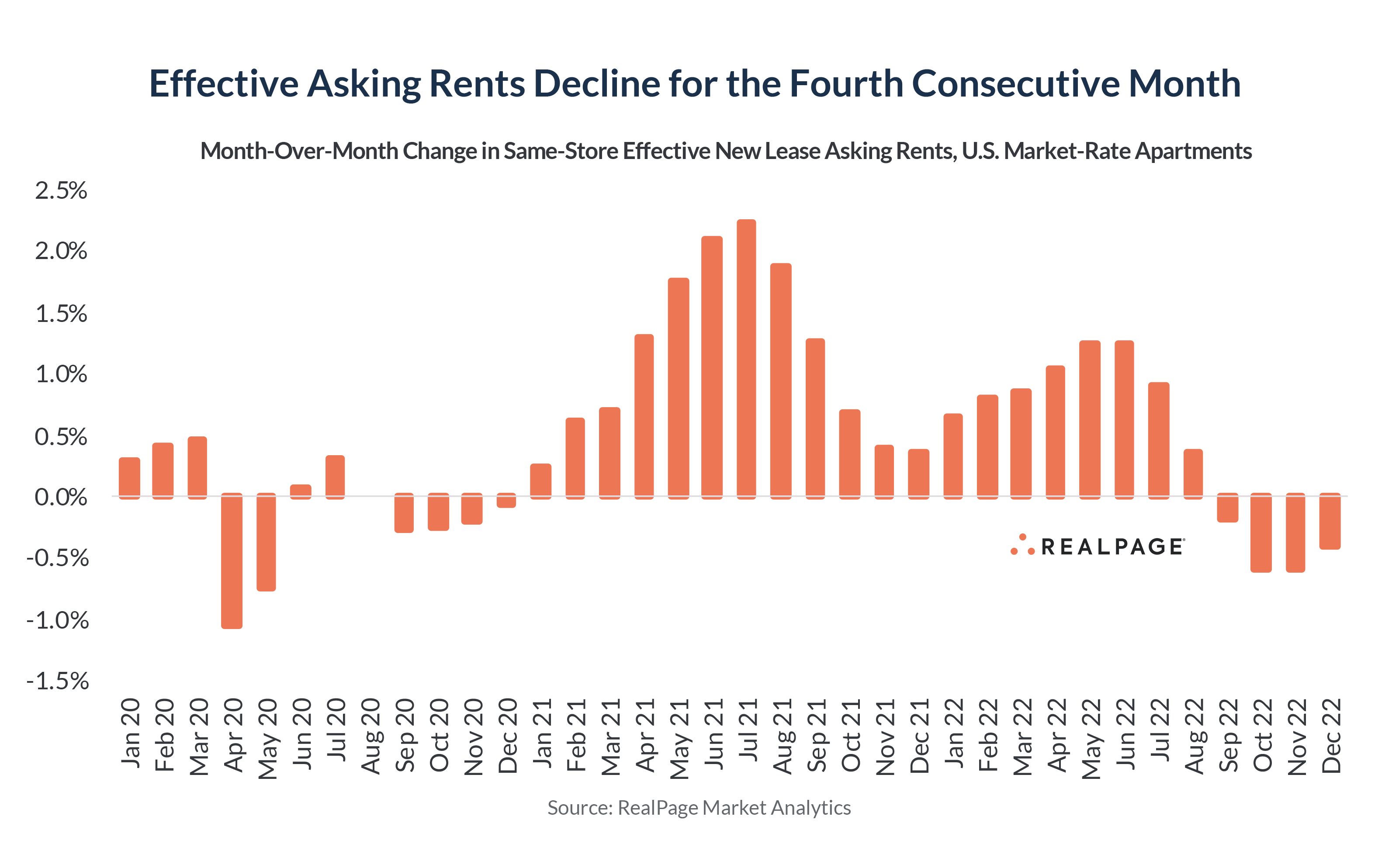

New-lease apartment rents fell in December for the fourth consecutive month amidst soft demand, dropping another 0.4%. While rent cuts in the winter months are seasonally common, the cumulative rent drop of about 1.6% since September is deeper than normal. And further cuts appear likely in early 2023 – especially in Class A apartments competing with the oncoming wave of newly built lease-ups.

For calendar year 2022 overall, effective new lease asking rents increased 6.1% nationally. That number was inflated by large hikes earlier in the year but has dropped off precipitously since peaking at 15.7% in March. Further cooling will continue into 2023.

Two key, once-red-hot markets have already seen rents declining on a year-over-year basis – with effective asking rents dropping 0.5% in Phoenix and 0.2% in Las Vegas in calendar 2022. (Both also saw big vacancy spikes in 2022.) Other markets will likely join them in negative territory in coming months.

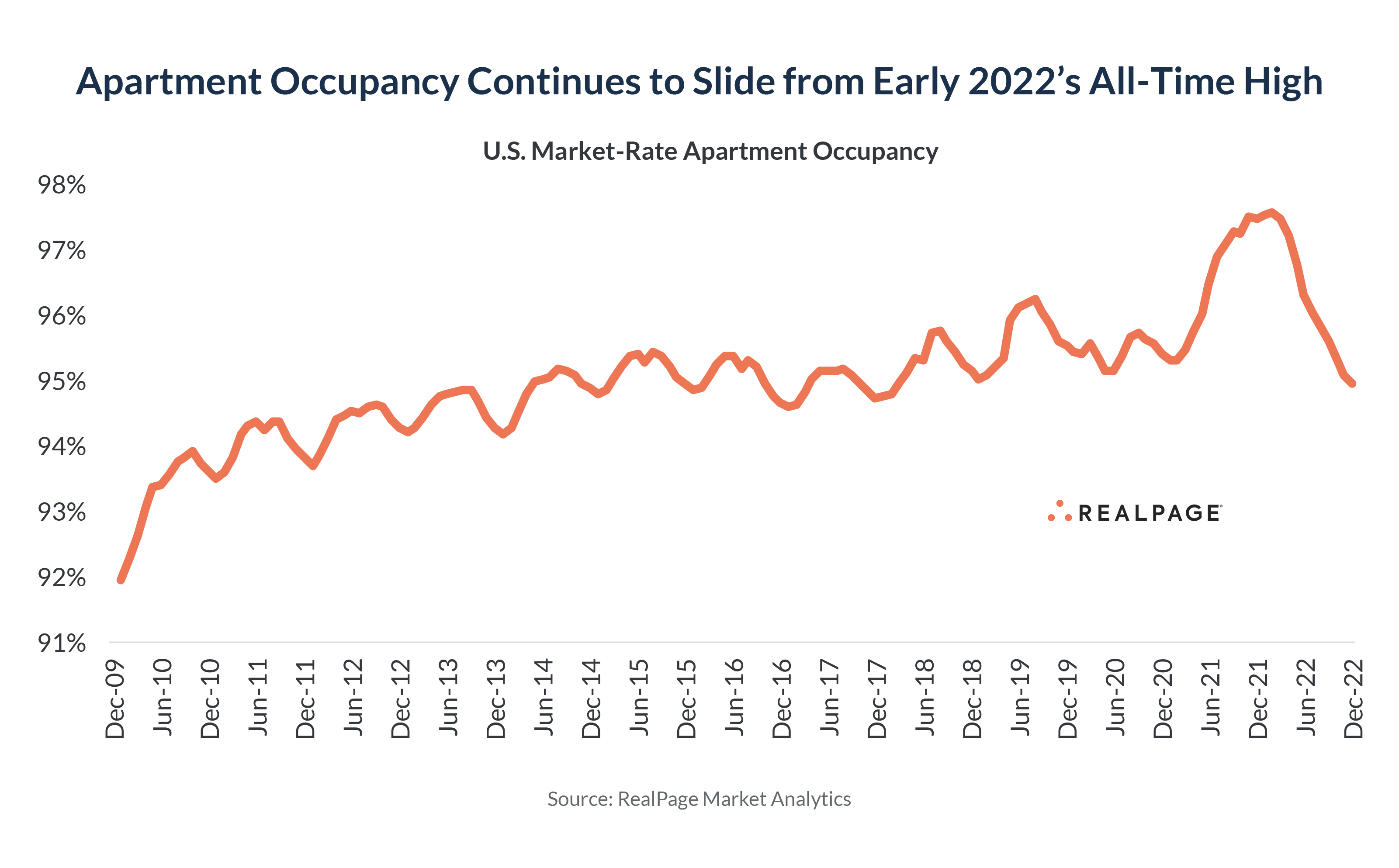

Bottom line is the rental market is rapidly shifting in the favor of renters. National apartment vacancy jumped from a record seasonal low one year ago of 2.5% up to 5.0% in December 2022. Vacancy increased over the past year in all but two of the nation’s 150 largest metro areas, with the only exceptions being the tertiary markets of Midland/Odessa, TX, and Youngstown, OH.

Vacancy will almost certainly increase more in 2023 as new supply surges to the highest levels in four decades. A total of 971,356 apartment units were under construction at the end of 2022, with about 575,500 scheduled to complete in 2023. New starts continued at a brisk pace through 2022, too (though will likely plunge over the next few months), which means lease-up volumes will remain elevated well into 2024.

Apartment completions will be well above average in nearly all sizable markets across the country, and especially in urban core submarkets.

New supply will especially impact the upper-tier Class A market competing for upper-income renters. The widening gap in rents between Class B/C and newly built lease-ups suggest that middle- and lower-tier apartments will be somewhat (though not entirely) insulated from supply pressures. In some markets, it’d take five to six months of “free rent” concessions to bring lease-up rents on par with Class B rents. That means it’ll be tougher for lease-ups to lure renters out of Class B apartments with concessions than it had been in prior cycles.