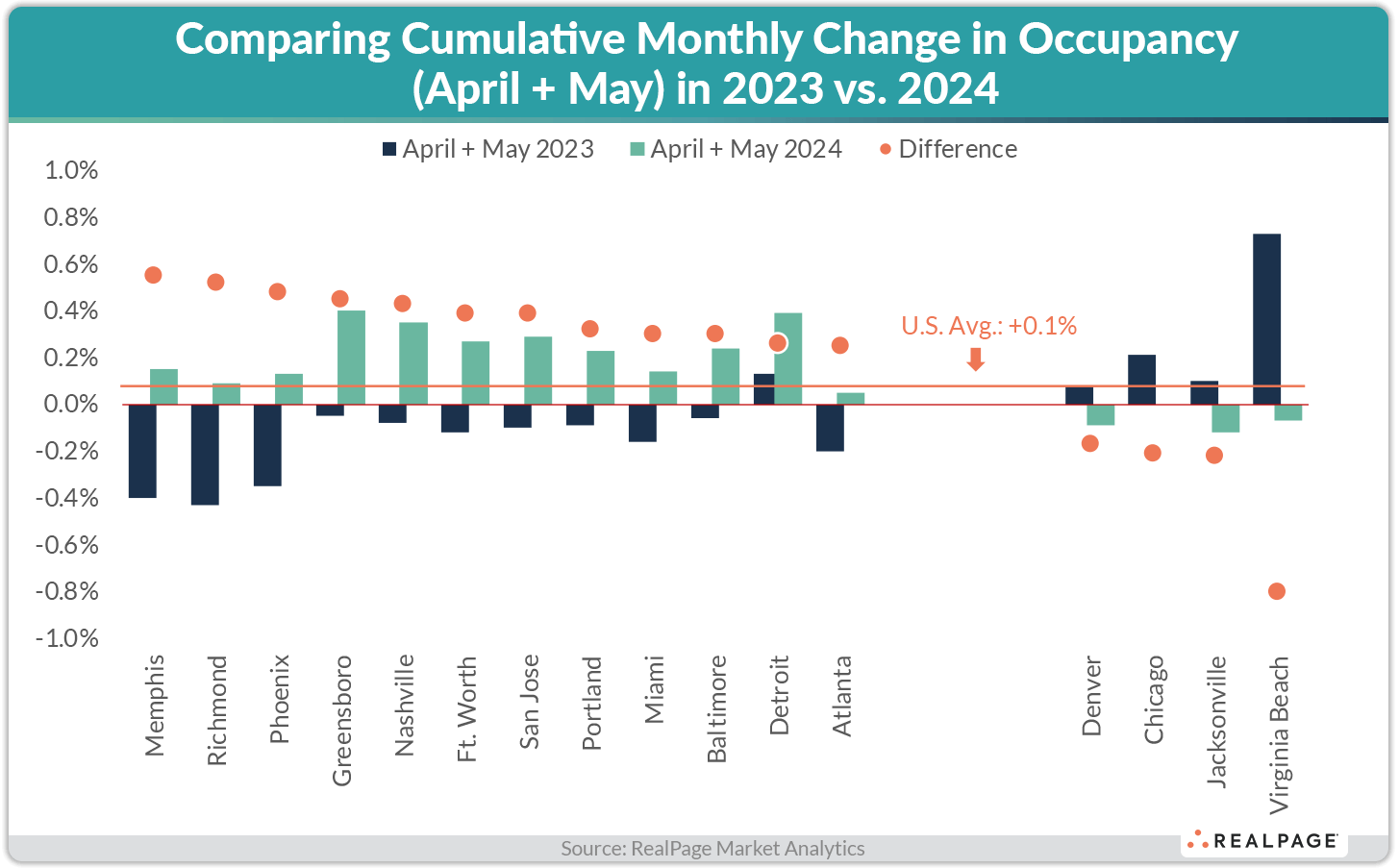

A sum of April and May's month-over-month apartment occupancy increases shows that most markets across the country are seeing signs of improvement in local readings.

The nation overall saw April and May combine for a 0.1% increase in occupancy, according to data from RealPage Market Analytics. The same time last year, occupancy rates ticked down by a rounding error of -0.02%.

Even though that was a miniscule drop, the fact that occupancy was falling during some of the busier leasing months suggested 2023 was going to be tough sledding. And as shared earlier this week, a 0.1% increase for April and May 2024 is modest by historic comparisons. But you have to keep in mind the sheer volume of units delivering to appreciate the relative resilience of occupancy.

Looking by market, it appears that many metros are finally seeing those demand numbers catch back up closer to supply. In some instances, such as Memphis, Greensboro/Winston-Salem and Baltimore, it's less about demand catching back up to supply; rather, these markets seem to have just finally found their floor. Memphis, for example, saw occupancy fall by 0.4% during April and May in 2023. This year however, rates increased by about 0.2% resulting in a year-over-year change of about 0.6%. That's a big swing in the grand scheme of it all.

Perhaps more impressive are the places like Phoenix, Nashville and even Ft. Worth, where occupancy recorded modest-to-strong improvement in 2024. In Phoenix, occupancy increased about 0.15% in April and May 2024. This same time last year, occupancy was approaching a 0.4% contraction. Arguably more impressive is Nashville's bump of nearly 0.4% in April and May of this year.

In the case of those markets (could add Richmond in there too), it appears that the story is one of demand catching back up to supply. There's still a lot of work left to be done in those markets because deliveries will continue to mount. But all considered, demand is doing its fair share of the work.

San Jose and Portland meanwhile are two West Coast markets that are encouraging to see on the list. Might those local economies be seeing some green shoots after a really tough 2022 and 2023, thereby improving demand going into the summer?

Two markets I might be wary of for the coming few months: Denver and Jacksonville. Jacksonville saw occupancy fall over the past two months, now at 92%. With another 8% of existing inventory scheduled to deliver in the coming 24 months, Jacksonville may be in a difficult spot.

Full transparency: Denver is a market that I've been consistently wrong on for the past few quarters. I've been saying the market would be weaker than what's actually transpired, but again, the data suggests to me that Denver could face some challenges in 2024 and 2025. Occupancy is down 0.1% in April and May. That may be splitting hairs but consider that 2024's forecasted supply tally (22,500 units) represents a dramatic 134% increase above 2023's deliveries (9,600 units) and the concern becomes apparent.