As supply levels nationwide have surpassed the largest volumes seen in more than 50 years, apartment fundamentals in market-rate multifamily assets have softened. Nearly 1 million new units have delivered since the start of 2023, putting downward pressure across all product segments, not just those units at the top of the pricing spectrum as has been typically seen historically.

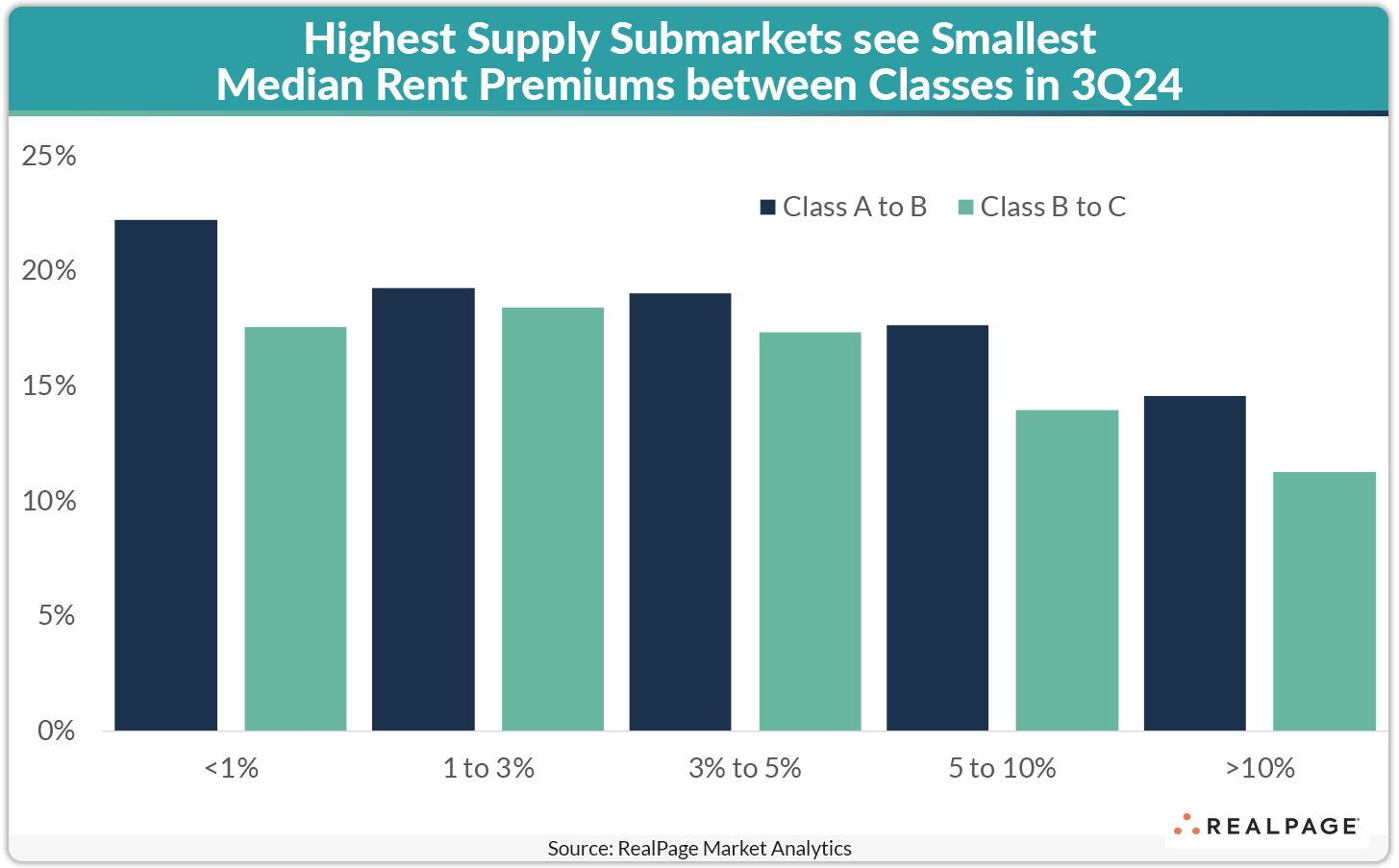

Submarkets in the nation’s 150 largest apartment markets with the largest inventory growth in the year-ending 3rd quarter 2024 registered the narrowest median pricing premiums between asset classes. In submarkets with less than 1% inventory growth year-over-year, Class A units recorded the largest median premium of 22% in 2024’s 3rd quarter. Meanwhile, submarkets with more than 10% growth annually saw the smallest Class A premiums of under 15%, according to data from RealPage Market Analytics.

In other words, it is 7% more expensive for a Class B renter in a low-supply submarket to move into a luxury Class A unit today compared to one in a high-supply submarket.

Of the roughly 700 submarkets in the nation’s 50 largest apartment markets, nearly two-thirds registered minimal inventory growth (1% or less year-over-year). On the opposite end of the spectrum, 21% of top 50 submarkets have expanded their apartment inventory greater than 5% over the last year.

Among low supply submarkets, Detroit’s Royal Oak/Oak Park submarket registered the largest Class A premium in 3rd quarter 2024. With a meager 0.7% inventory growth annually, Royal Oak/Oak Park’s Class A units registered an average rent 66% greater than Class B prices. Pittsburgh’s Westmoreland/Fayette Counties – which completed no new supply in the last 12 months – was a close no. 2 nationally with Class A rents sitting nearly 61% above Class B prices.

Comparing Class B to Class C, the largest deltas in pricing were seen in four of New York’s Manhattan submarkets. The rent premiums for Class B units at the top of the leaderboard ranged from 83% in Midtown West to more than double (108%) the average Class C rent in Midtown East. Outside of the Big Apple, San Diego’s La Jolla/University City held the largest pricing premium for Class B units of 64.5%.

In major submarkets seeing inventory growth of greater than 10% annually, the premiums for Class A and B units were substantially smaller. Indianapolis’s Greenwood/Johnson County registered the largest pricing delta for both Class A and Class B units of 29.1% and 25.1%, respectively. In Texas, North Central Austin (27.7%) and East Austin (26.9%) ranked no. 2 and 3 for largest Class A premiums, respectively, while Houston’s Rosenberg/Richmond submarket ranked no. 2 in Class B rent premiums, with a delta of 24.9% in 3rd quarter 2024.