Loss to Lease is Plunging, Suggesting Renewal Rent Growth Will Cool Off

Last week, Federal Reserve Chair Jerome Powell dove into the debate over rent inflation and suggested that while new lease rent growth is slowing, “there’s still some significant (rent) increases coming” via cheaper lease renewals hiked up to market level.

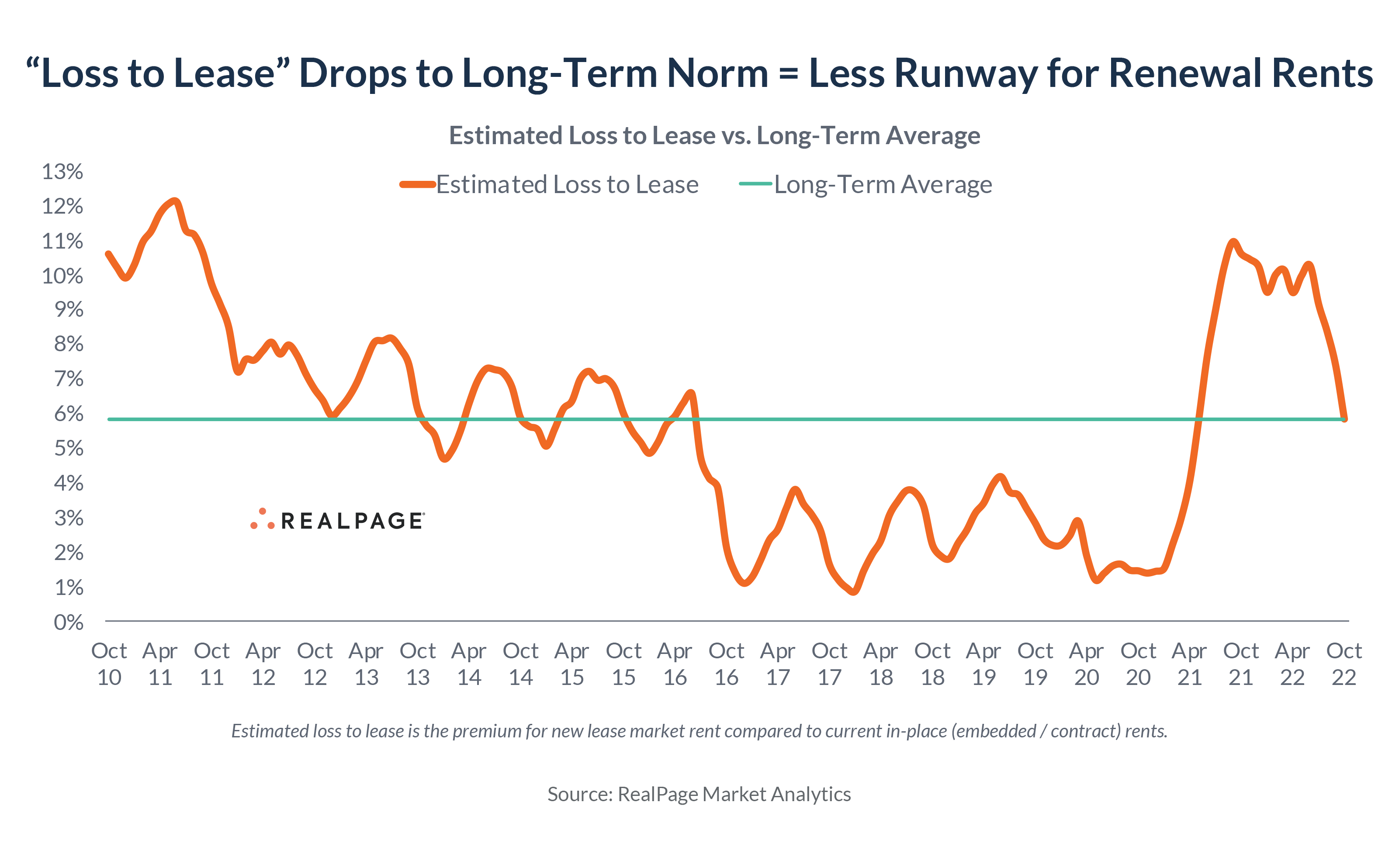

But RealPage data show that’s NOT exactly true for market-rate apartments. U.S. apartments plunged back to the long-term average in “loss to lease” – which means the runway for renewal lease rents will significantly narrow going forward.

“Loss to lease” is the gap between today’s market asking rents and the average in-place rent (aka embedded or contract rent, which is what the CPI attempts to measure). As a general rule of thumb: The larger the loss to lease, the larger the renewal increase.

“Loss to lease” is the gap between today’s market asking rents and the average in-place rent (aka embedded or contract rent, which is what the CPI attempts to measure). As a general rule of thumb: The larger the loss to lease, the larger the renewal increase.

Here’s what Powell said: “As non-new leases roll over … there’s still some significant (rent) increases coming, OK, but at some point, once you get through that, the new leases are going to tell you … there will come a point at which rent inflation will start to come down. That point is well out from where we are now.”

He’s referring to lease renewals in the CPI; however, in the U.S. market-rate apartment sector, that point is actually now. Loss to lease plunged from 9.4% in June to 5.8% in October, thanks to decelerating new lease rents and (until now) accelerating renewals. That’s exactly matching the historical average since 2010.

It’s critical to acknowledge there is ALWAYS some loss to lease because there’s usually a discount for renewals relative to new leases. (It’s equally important not to misinterpret this to mean renewal rents won’t increase as new leases decrease. This just means the nominal rent value paid by a renewing renter is almost always below what a new renter would pay coming through the front door.)

A “gain to lease” scenario is unlikely as we'd have what’s called “inverted rents” – incentivizing renters to move from one unit to another at the same apartment property.

Property managers routinely discount renewals for a few key reasons: First, most operators want to incentivize renewals to keep vacancy low, especially in a low-demand environment like we have now. Second, operators usually want to reward renters in good standing. Third, renewals eliminate turnover costs – such as paint and carpet and other work – that occur when a renter moves out.

Rents play a major role in how the government measures inflation, serving as the largest variable in the CPI’s largest category – shelter, which comprises nearly one-third of the CPI’s weighting. The rent survey is used not only to measure rent, but also the homeowner cost proxy known as OER – owners’ equivalent rent, with very slight methodology adjustments.

The lag from new lease asking rents to CPI rents has been a hot topic among Fed watchers and economists, but this loss to lease data further supports the view that the CPI rents are additionally lagged behind actual embedded rents.

What does all this mean? Three things:

1. Renewal rent increases will almost certainly cool significantly going forward.

2. CPI’s Shelter measure (which is almost entirely driven by a rent survey) is a lagged indicator not only of new lease rents (the first domino to fall) but also the embedded contract rent.

3. For real estate investors: Loss to lease is a measure of upside and helped justify low cap rates the past couple years. Cap rates will have to expand somewhat given both a) higher rates and b) lower loss to lease.