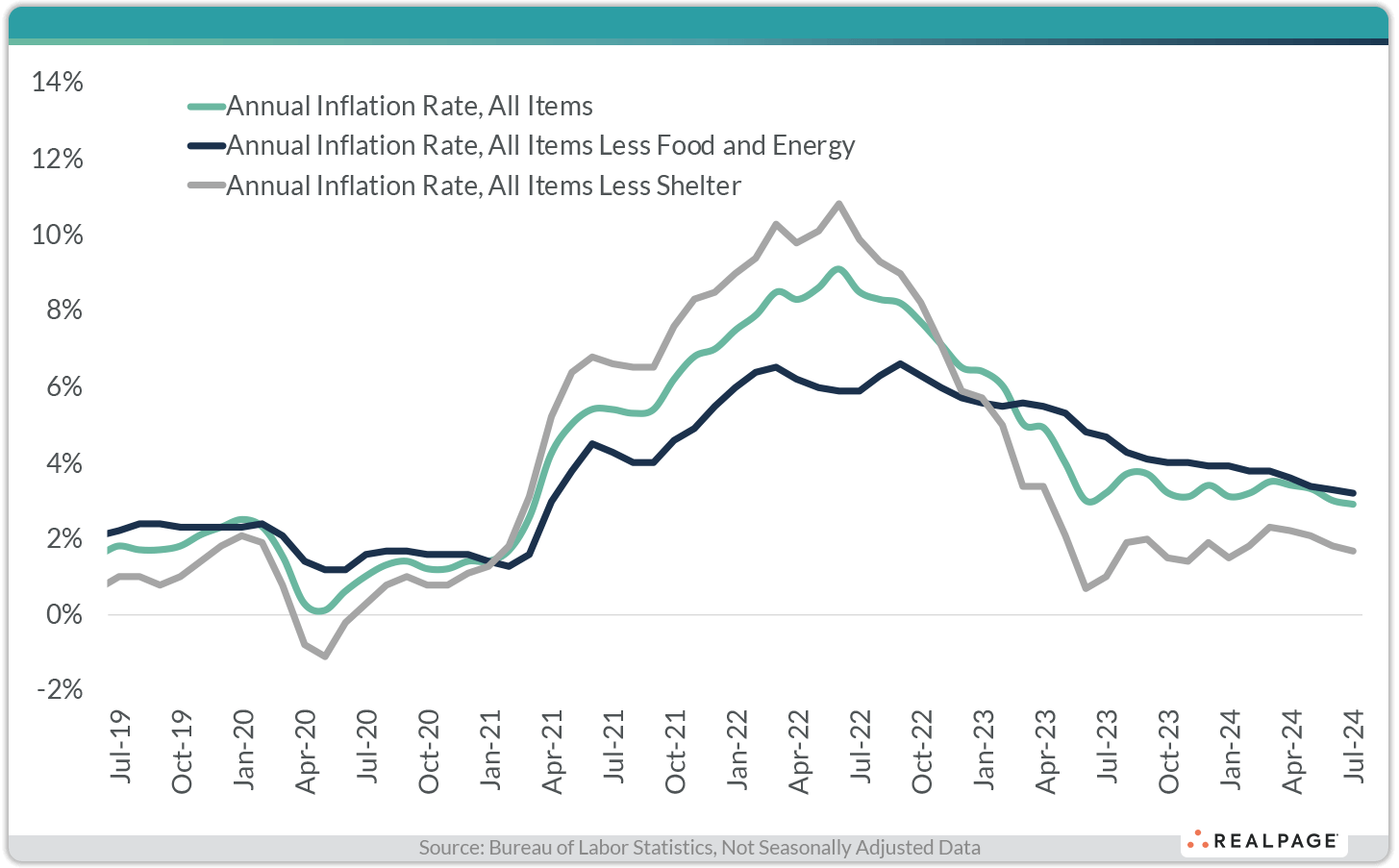

U.S. Inflation Falls Below 3% for the First Time in Over Three Years

The Federal Reserve’s efforts to curb inflation appear to be working, as consumer prices continued to trend down in July. The news could signal an interest rate cut by the Fed in September. The price of goods and services paid by U.S. consumers rose 2.9% in the year-ending July, according to the Consumer Price Index (CPI) for All Urban Consumers measured by the Bureau of Labor Statistics. That was the smallest 12-month upturn since March 2021 – a welcomed sign that inflation is trending in the right direction and heading toward the Fed’s target rate of 2%. Inflation has cooled considerably since reaching a 40-year high of 9.1% in June 2022. For comparison, the inflation rate averaged 1.6% annually in the five years leading up to the COVID-19 pandemic (2015-2019). Core inflation, which strips out volatile costs of food and energy, was up 3.2% year-over-year in July, which was the smallest annual increase since April 2021. The energy index rose 1.1% in the year-ending July, with the price of electricity rising 4.9% over the past year, while gas prices declined 2.2%. The cost of shelter, which is keeping the overall inflation rate elevated, rose 5.1% from a year ago. Still, that was the slowest increase in over two years. However, the shelter index has a well-documented lag effect. Excluding the cost of shelter, consumer prices were up just 1.7% year-over-year in July.