Apartment Occupancy and Rent Growth Continue to Stabilize in July

The U.S. apartment market continued to stabilize in July.

Occupancy in market-rate apartments held steady at 94.2% in July, marking the third straight month of occupancy remaining at that rate. Historically speaking, occupancy tends to level off in July.

Effective asking rents grew 0.3% during the month of July. That was less than the typical July pace from the 2010s decade but represented a 10-basis point (bps) increase over the July 2023 figure. Year-to-date in 2024, rents expanded 2.2%, in line with the year-to-date 2023 pace.

Recent rent growth pushed the annual change to 0.3% as of July, according to data from RealPage Market Analytics.

Concession utilization appears to be levelling off as well. As of July, nearly 14% of units were offering a concession, in line with the June figure. The average discount being offered did increase a bit, to 28 days. As always, however, concessions are a hyper-local phenomenon, so performances varied by market.

West Region Occupancy Close to Leveling Off

The West region is close to seeing apartment occupancy level off. Occupancy was down just 10 bps year-over-year as of July. The downside is that occupancy as of July (94.6%) was still more than 100 bps below the 10-year norm. That said, occupancy among major markets in the West region was split between the non-coastal markets (Phoenix, Salt Lake, Las Vegas and Denver were all below 94%) and the coastal markets (Orange County, Bay Area and San Diego were all above 95%).

South Region Rents Still Seeing Impact

The South region continues to see rents impacted by generationally high supply levels, but there are some pretty wide ranges of performance here. A total of 18 of the region's 65 key markets recorded rent cuts both month-over-month and year-over-year in July. Florida markets made up 10 of those 18 markets. Among Texas’ five major markets, monthly rent cuts were recorded in Austin and San Antonio, which continue to see rents freefall. Charlotte and Raleigh/Durham, on the other hand, saw rents increase during the month. In Charlotte, that marks four straight months of positive month-over-month change. In Raleigh, it's the third-straight month. And finally, rents in Atlanta continue to fall further with a 0.5% contraction in the month of July (now at a nearly 5% rent reduction year-over-year).

The Midwest region had a July occupancy reading (94.8%) that was 20 bps above its January figure. In turn, rents have increased 2.8% over the past 12 months.

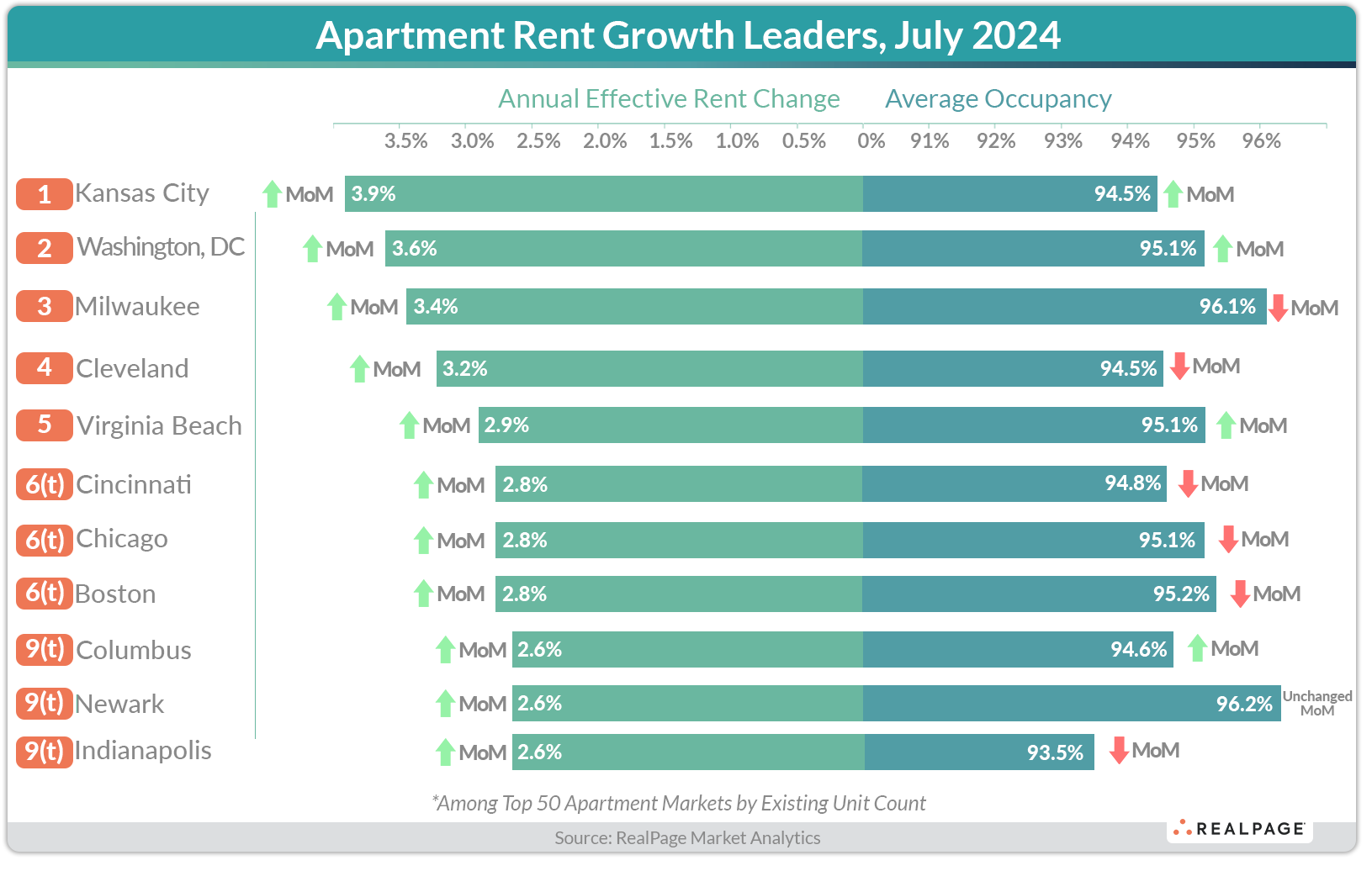

Midwest markets continue to lead nationwide for rent growth. Of the four major markets that posted annual price increases of more than 3% in July, all but one – Washington, DC – were in the Midwest.

The Northeast region is on a similar trajectory with July occupancy (95.7%) matching its January figure while rents were up 2.7% over the past 12 months. Interestingly, only one of the 50 key markets that comprise the Midwest and Northeast regions saw a year-over-year rent cut. That market was Sioux Falls (a rarity in that its inventory growth is on par with Sun Belt standards, not Midwest standards).