Fayetteville’s Apartment Market Fundamentals Outperform U.S. Norms

Market fundamentals in the Fayetteville-Springdale-Rogers, AR-MO apartment market have held up relatively well amid underlying demand drivers, despite some recent softening.

Like most apartment markets across the country, Fayetteville has been experiencing deflating market fundamentals after a surge in occupancy and rents in 2021 and 2022. However, this apartment market with roughly 41,000 existing units typically registers occupancy above the U.S. norm and recent rent growth has been outperforming the national average.

Located in northwest Arkansas, this market sits within the southwestern portion of the Ozarks. The county seat of Washington County, Fayetteville is the second most populated metropolitan area in the state, with roughly 590,400 people, according to 2023 estimates from the U.S. Census Bureau. The area has also been the state’s fastest growing, with its population increasing 7.3% from 2020 to 2023. That was the 10th fastest expansion rate among the nation’s core 150 apartment markets and far outpaced the national average growth rate of 1% during that same period.

Despite some recent softening, Fayetteville’s apartment occupancy has remained above the U.S. average for nearly 12 years. In April 2024, occupancy in the market registered at 94.8%, according to data from RealPage Market Analytics. That was the third consecutive monthly reading below 95%, the first such occurrence since 2012.

Still, Fayetteville’s April occupancy rate registered 60 basis points above the national average. For comparison, during the five years leading up to the pandemic (2015-2019), occupancy in Fayetteville averaged 98%, well above the national average of 95.2%.

Looking at asset classes in Fayetteville, Class C by far had the tightest occupancy as of April at 97.9%, while Class B was 94.7% occupied. Class A lagged with occupancy at 91.9%. In the five years leading up to the pandemic (2015-2019), occupancy among product classes was tightly clustered around 97% to 99%, with Class C averaging 99.2% occupancy, followed by Class B at 98.2% and Class A at 97.1%. Among submarkets, April 2024 occupancy was tightest at 96.1% in the Fayetteville submarket, which is home to the University of Arkansas. That submarket generally leads for occupancy and averaged a rate of 98.2% during the five years prior to the pandemic. The only other submarket, Springdale/Rogers/Bentonville, was 94.4% occupied as of April and averaged occupancy of 97.8% during the five years leading up to the pandemic.

With occupancy trending down, apartment operators in Fayetteville have eased up on rent hikes. After reaching unsustainable double-digit annual rent growth throughout 2022 and into early 2023, prices have been rising at slower rates. Still, the 2.8% year-over-year rent growth the market achieved in April registered well above the U.S. average of 0.1%. While Fayetteville’s recent annual rent growth was below its pre-pandemic five-year average of 3.4%, the market has managed to outperform the U.S. average for rent growth over the past two years. As of April 2024, rents in Fayetteville averaged $1,148 per month, well below the national average of $1,819.

Despite Class A product having the weakest occupancy rate recently, those units managed to post Fayetteville’s most significant annual rent increase of 5.2% in April. Class C units also posted a hefty rent increase of 4.1%, while Class B units recorded year-over-year rent growth of just 0.8%. In the five years leading up to the pandemic, Class A units generally lead for rent growth, with an average annual increase of 3.6%, followed by Class B product at 3.3%. Class C product trailed with a 2.6% average annual increase during that five-year period.

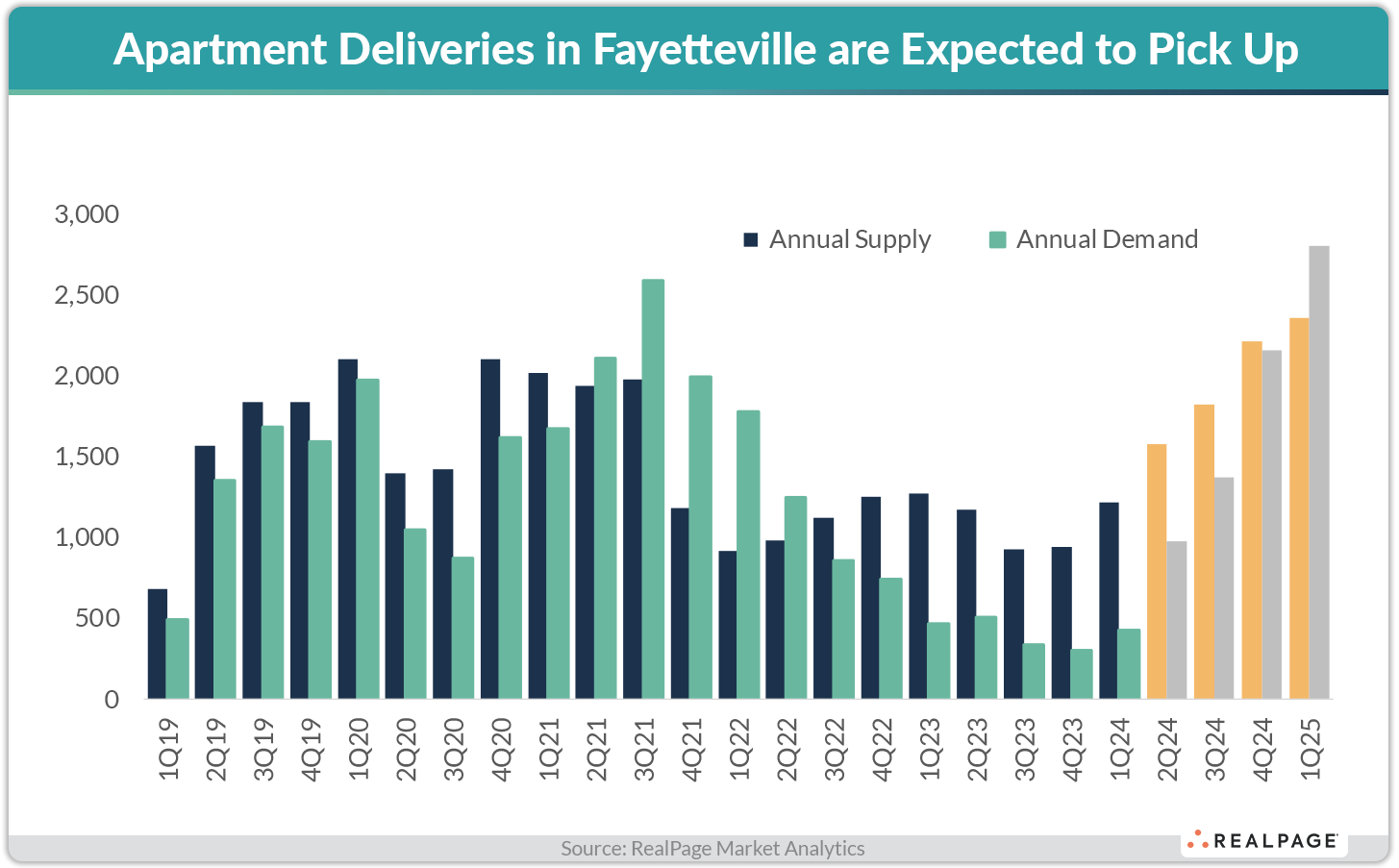

Contributing to Fayetteville’s softening apartment market fundamentals, new supply has been moderate by local standards while demand has been weak. A total of 1,217 units delivered in the year-ending 1st quarter 2024. Those completions expanded the local inventory base 3.1%, above the national average growth pace of 2.5% but in line with Fayetteville’s pre-pandemic growth rate of 3.2%. Still, new completions over the past year far exceeded concurrent demand for just 427 units. Deliveries are expected to set a record high of 2,362 units in the coming year, with that supply volume representing 5.8% of existing stock. That is above the expected U.S. average inventory expansion of 3.5%.

The bulk of Fayetteville’s new supply in the year-ending 1st quarter 2024 came online in the Springdale/Rogers/Bentonville submarket, with a total of 1,186 units completed. The Fayetteville submarket only received 31 units. Over the past five years, new supply was concentrated in Springdale/Rogers/Bentonville, which received 93% of the market’s total completions. Completions in the coming year are expected to remain concentrated in Springdale/Rogers/Bentonville, as 2,286 units are scheduled for completion there. The Fayetteville submarket is expected to receive just 76 units in the coming year.

While completions are expected to pick up in the coming year, demand is also anticipated to increase, providing a significant boost to occupancy. With occupancy anticipated to rise, operators are expected to continue to push rents closer to pre-pandemic norms.

The key to Fayetteville’s apartment market resilience is the local economy. In the five years leading up to the pandemic (2015-2019), Fayetteville’s job base grew an average of 3.5% annually, above the national average of 1.9%. Most recently, Fayetteville added 9,300 jobs in the year-ending April 2024 for a job base expansion of 3%. While Fayetteville’s recent job growth level was slightly below the market’s historic norms, it exceeded the national growth pace of 1.8% and was a top five growth rate among the nation’s 150 largest apartment markets.

Fayetteville’s job market didn’t suffer as big of a job base contraction as most other markets during the onset of the pandemic and therefore didn’t have as much ground to make up. Since the pandemic (February 2020), the job base in Fayetteville has expanded 13.1%, the ninth-best recovery among the nation’s core 150 markets. The Fayetteville metro area also has one of the lowest unemployment rates in the nation. At 2.3%, Fayetteville’s April unemployment rate was the 10th lowest among the nation’s 150 largest apartment markets.

The area is home to three Fortune 500 companies including Walmart in Bentonville, Tyson Foods in Springdale and J.B. Hunt Transport Services in Lowell. Walmart is the area’s largest employer with nearly 30,000 employees, followed by Tyson Foods (7,500 employees). Fayetteville is also home to the state’s flagship university, the University of Arkansas (U of A). The university employs around 4,200 people and had an enrollment of 32,140 students in fall 2023, its highest-ever fall enrollment. Those organizations provide a strong economic base and solid demand drivers.

U of A plays a key role in the Fayetteville economy, so it makes sense to evaluate student housing performance here as well. Inventory of privately-owned student housing at the U of A has grown by half in the last decade as a result of a sustained supply wave. From Fall 2012 to Fall 2023, the university added nearly 8,500 student housing beds, propelling total inventory to just under 20,000 beds. Like many other large, flagship universities in the southeast, U of A has been a top performer in both student housing rent growth and occupancy in the last couple years. Among privately owned student housing beds at U of A, rents were up 9.6% year-over-year as of April. That marked one of the highest rates among the core 175 universities tracked by RealPage. In addition, student housing beds at U of A were 88.2% pre-leased for the fall 2024 academic year as of April, also one of the highest rates across the U.S.