Apartment Rent-to-Income Levels Held Steady Over the Last Decade

Renters in market-rate, professionally managed apartments tend to command significantly higher wages and pay a materially lower share of income toward rent when compared to the broader renter population, according to a new study by RealPage analyzing millions of leases signed over the last decade.

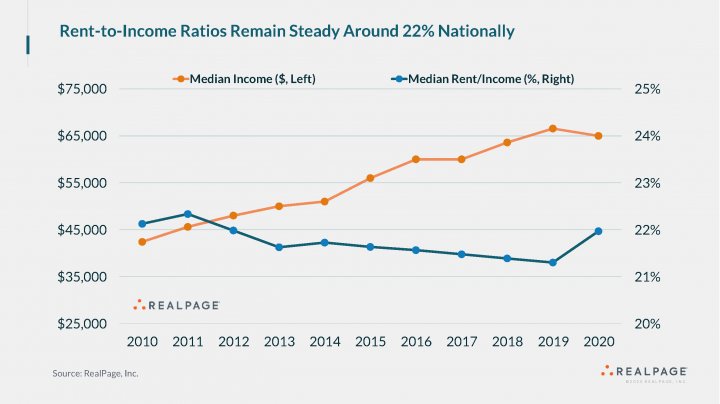

Median rent-to-income ratios consistently hovered around 22% between 2010 and 2020 in professionally managed, market-rate apartments – which comprise about 30% of the nation’s 47.2 million rentals. Rent growth over the last decade appears to be offset by rising incomes in this segment of the market. Additionally, the study showed remarkably little variability in rent-to-income ratios among the nation’s 50 largest metro areas in 2020.

Another fascinating finding: Affordability is inversely correlated with rent level. Renters in the most expensive units tend to spend the lowest share of income toward rent, while renters in cheaper units spend a somewhat larger share.

RealPage’s analysis brings new insights into intensifying discussions on rental affordability across the country. However, the results should not be misinterpreted to suggest affordability problems do not exist. Previous studies have conclusively shown serious challenges, but few have zeroed into differences among rental housing types.

RealPage analyzed actual rent and income data for millions of renters at the time of initial lease signing. (Renewal situations were excluded, since property managers rarely request income information for residents renewing leases.) Properties in the dataset are generally larger apartment communities with on-site management.

In this analysis, the median household income registered at $65,000 in 2020. That’s well above the median income of $42,500 among all renter housing types, according to Census data from 2019, the most recent period available. Additionally, the median rent-to-income ratio of 22.0% indicates lesser affordability challenges compared to other types of rentals. For comparison, Harvard’s Joint Center for Housing Studies concluded about half of all renters nationally pay at least 30% of income on rent.

COVID-19 Brings Slight Changes

Rent-to-income levels did inch up slightly from 21.3% in 2019 to 22.0% in 2020, even though new lease rents actually fell 1% nationally. That snapped a streak of five straight years of declining rent-to-income ratios among incoming renters. The 2020 uptick traces to incoming renters with slightly lower incomes, particularly in large coastal cities where deeper rent cuts attracted lesser-income renters who previously might not have rented at pre-COVID rates.

The good news is renter incomes are now increasing again in 2021, as rents jump again as well. Early results show incomes for new lease signers surging above $70,000. RealPage will update the rent-to-income analysis with 2021 data after year end.

Affordability Varies Little by Metro Area

Among the nation’s 50 largest metro areas, there’s surprisingly little variability in affordability. Rent-to-income levels in professionally managed apartments in 2020 ranged from 17.8% in Pittsburgh to 25.1% in Riverside.

Of course, there is wide variability in rent and income levels by metro. That means America’s most expensive markets tend to cater to the highest-income renters. Among new lease signers in professionally managed, market-rate apartments in 2020, median household incomes reached $150,000 in San Francisco, $145,000 in New York, $144,000 in San Jose, $115,000 in Los Angeles and $102,000 in Orange County. In these markets, renters with lesser incomes tend to rent in other housing types.

At the other end, market-rate renter incomes were lowest at around $40,000 in both Memphis and Greensboro/Winston-Salem.

In all markets, there’s been no shortage of demand from upper-income households. As of August, vacancy rates came in below 5% in all of the nation’s 50 largest metros and below 3% in 26 of them.

Affordability Varies More by Asset Class

Perhaps counterintuitively: The more expensive the rent, the lower the rent-to-income ratio. RealPage studied renter incomes and affordability by asset class, which is generally correlated with rent level.

The median rent-to-income ratio in Class A+ properties – generally newest and priciest units – was just 19.4% in 2020 thanks to median incomes of $92,000. In Class B apartments – which are more average – the median renter made $57,780 in income and spent 21.7% toward rent.

On the flip side, renters in the cheapest apartments tend to spend the highest percentage of income on rent. Median rent-to-income ratios came in at 25.5% in Class C- and 27.0% in Class D properties that are generally older and lower-rent units. Renter households in those segments had incomes below $35,000.

Higher rent-to-income ratios in Class C apartments come despite lower rent growth in those units over the last decade. In Class C units, rents increased at an average annual rate of 2.35% nationally. By comparison, rents increased 3.19% on average in Class A and 3.25% in Class B.

Apartments Generally Cater to Higher-Income Renters

The type of apartments in the RealPage study resembles the composition of the National Multifamily Housing Council’s Rent Tracker, which has consistently shown significantly higher monthly rent collections (usually around 95%) when compared to other types of rentals. Higher collections likely trace to higher incomes.

In fact, income levels for new apartment lease signers have grown dramatically over the last decade – from $42,400 in 2010 to $65,000 in 2020. That does not mean the average renter saw that level of income growth. Much of the growth traces to higher-income households entering the renter pool. In its 2020 report on rental housing, Harvard concluded that “households with real incomes of at least $75,000 accounted for over three-quarters of the growth in renters” over the last decade. Not coincidentally, the growth in higher-income renters directly aligns with a surge in new luxury apartments built over the last decade.

Challenges Exist for Lower-Income Renters

At the same time, Harvard noted that about half of all renters spend at least 30% of their income toward rent – suggesting deeper affordability challenges in smaller mom-and-pop rentals and a lack of designated affordable housing.

RealPage’s analysis shows affordability is generally a non-issue in luxury rentals. But the real challenge is an environment that makes it exceedingly difficult for rental housing developers to build anything but high-rent luxury apartments – with restrictive zoning and NIMBYism rife throughout the country, further complicated by the high costs of development.

This creates a massive challenge for lower-income households, who often struggle to find available housing. While estimates vary on exact numbers, there’s clearly a severe shortage of affordable housing in the U.S. The White House has proposed funding to build or preserve 2 million affordable units – the most significant plan in decades – but it’s stalled in Congress.