Strong Apartment Demand Persists in 3rd Quarter as Supply Hits 50-Year High

Apartment demand again looked quite remarkable in 2024’s 3rd quarter, even as a record number of deliveries hit the market. In turn, rent growth remained quite muted nationwide, as has been the case for several months.

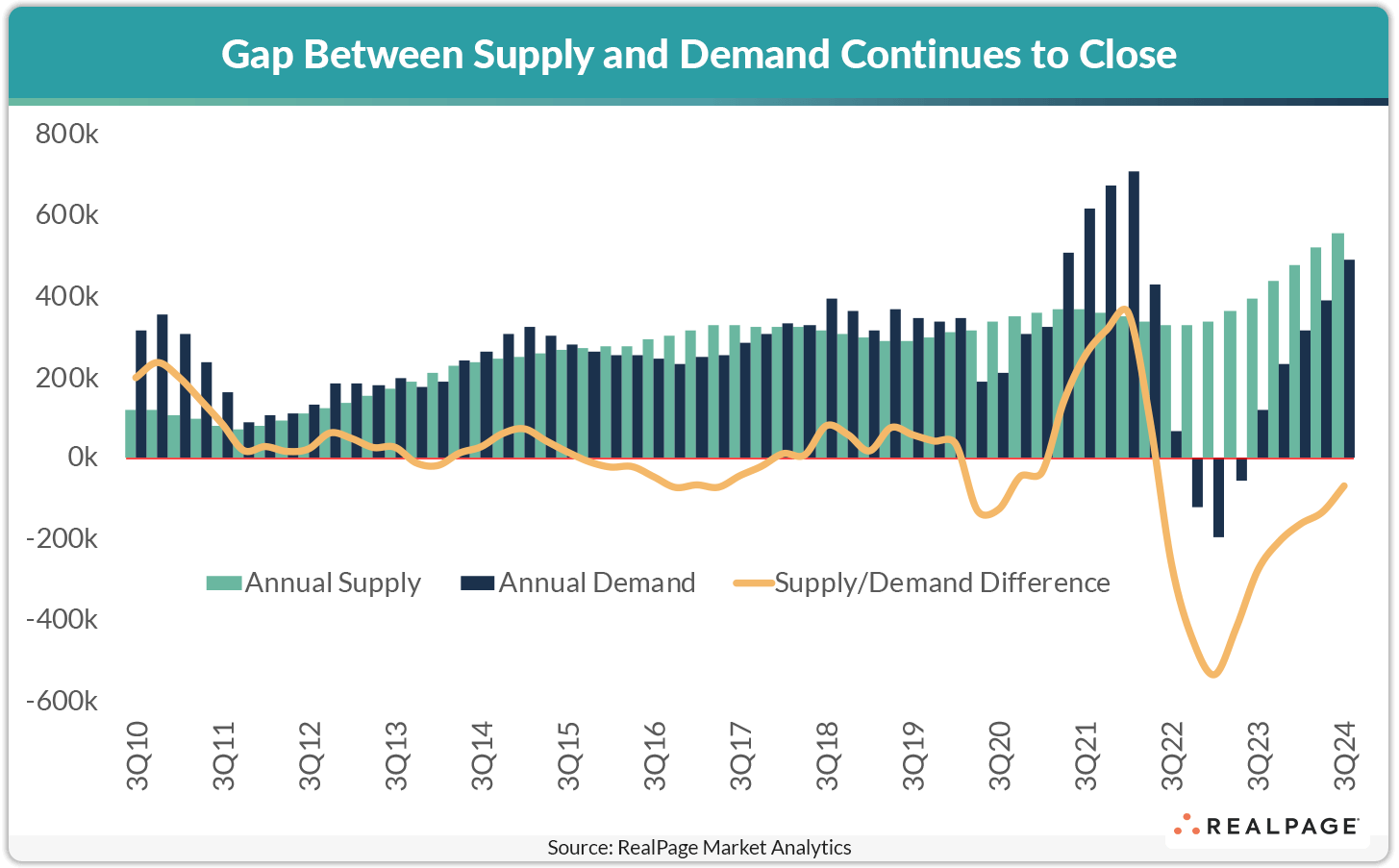

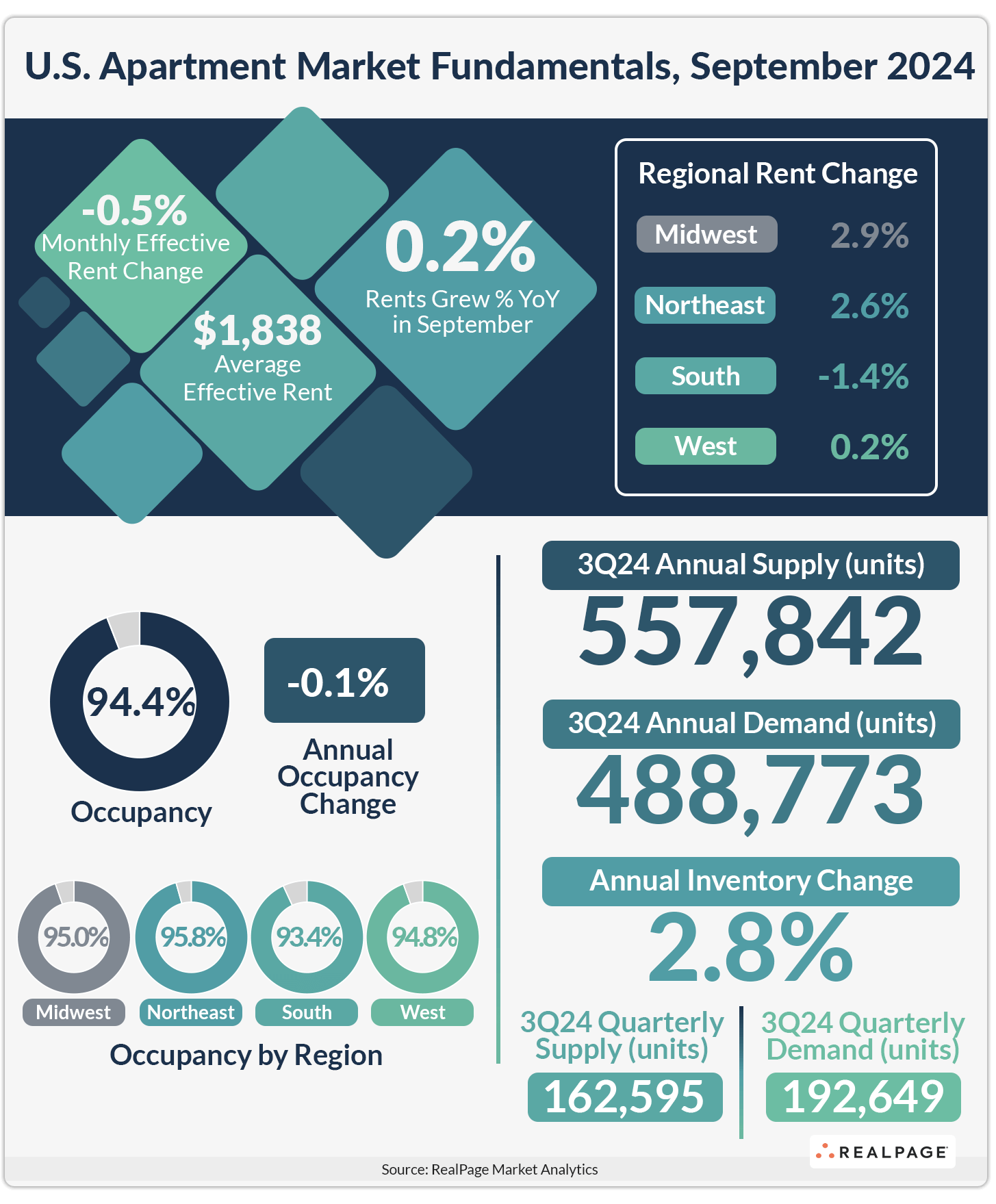

The U.S. apartment market absorbed 192,649 market rate apartment units in the July to September time frame. Concurrently, the U.S. delivered 162,595 apartment units. On an annual basis, supply reached 557,842 units, a rate unseen since 1974. While robust demand still fell below concurrent rates of new supply, the delta between the two was at the lowest point in two years. As of 3rd quarter 2024, the difference in annual supply and annual demand (488,773 units) registered just above 69,000 units.

Nationwide, occupancy in market-rate apartments stood at 94.4% in 3rd quarter, a rate that was down a mere 10 basis points (bps) from the year-ago figure. Monthly rent in market-rate apartments averaged $1,838 as of September 2024.

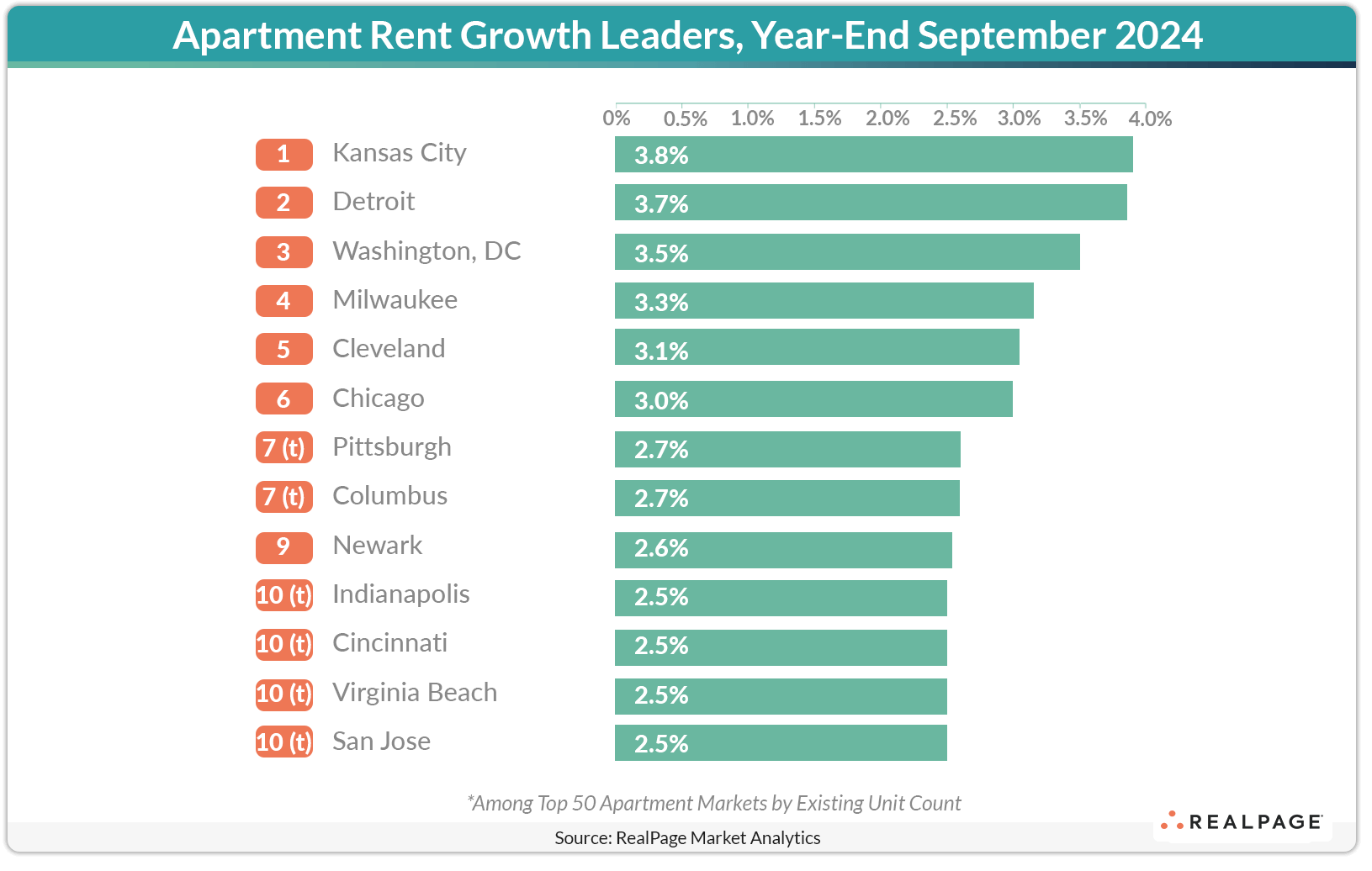

Midwest Markets Continue to Post Rent Growth Above National Norm

Most major apartment markets in the Midwest continued to post rent growth above the U.S. average in 3rd quarter. Congruently, Midwest markets have generally delivered more limited supply recently. The Midwest markets that have delivered the most new supply lately – Madison and Sioux Falls – have unsurprisingly seen rent growth slow considerably from one year ago.

Kansas City led the nation in annual apartment rent growth for major markets in the year-ending September 2024. Other Midwest markets, including Detroit, Milwaukee, Cleveland, Chicago, Columbus, Indianapolis and Cincinnati also ranked within the top 10 large markets nationally for annual rent growth.

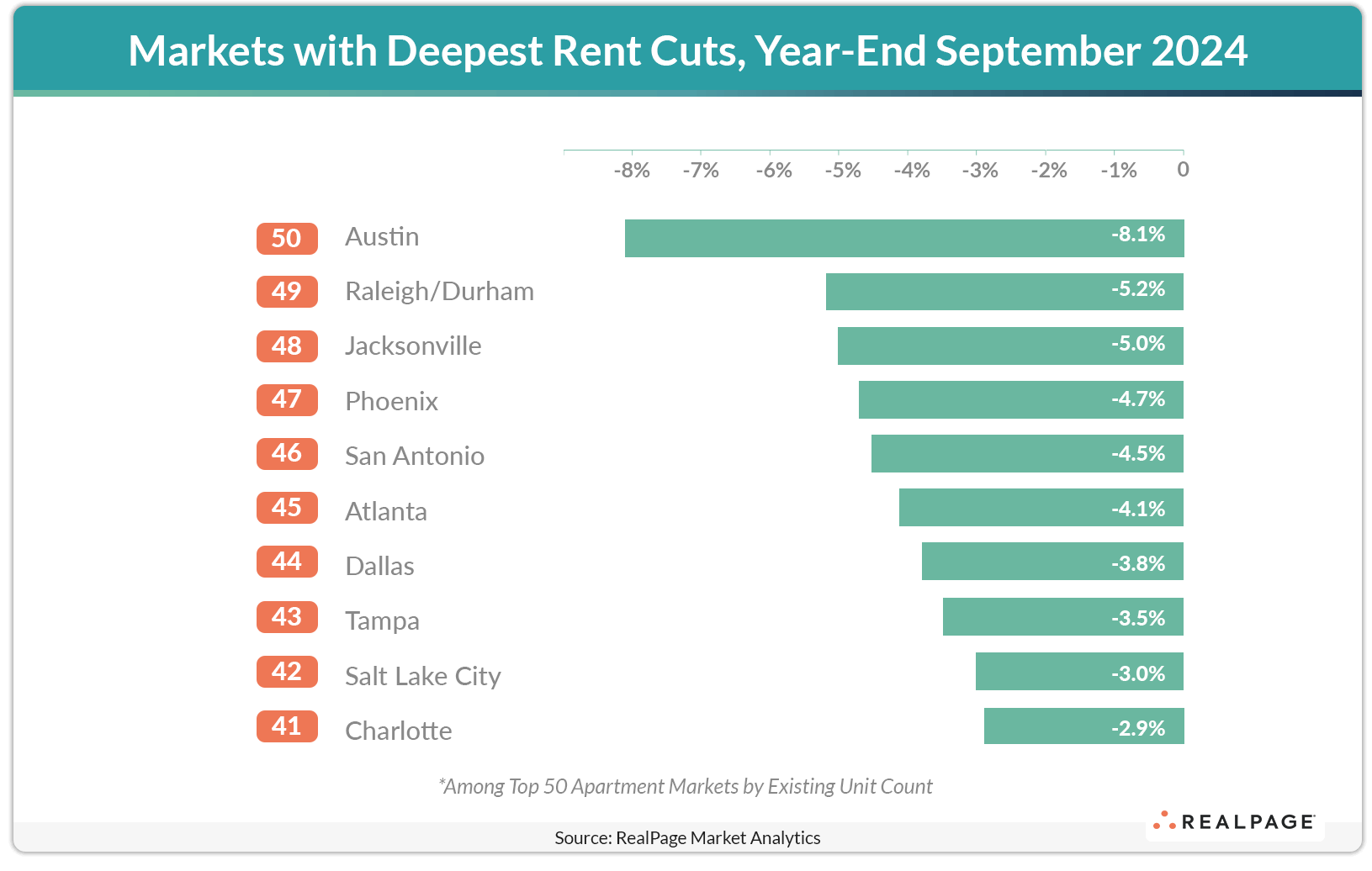

Just under half the nation’s 50 largest apartment markets (22) posted rent cuts in the year-ending September 2024. Supply heavyweight Austin again claimed the deepest rent cuts in the nation in September (-8.1%), followed by rent cuts deeper than 4% in Raleigh/Durham, Jacksonville, Phoenix, San Antonio and Atlanta. Those six markets have experienced considerable new supply, all growing total inventory by about 4.5% or more in the last year. In Austin, the nearly 27,000 units that delivered there in the last year grew total inventory a staggering 8.9%. Another 26,000 units are expected to deliver in the coming four quarters in Austin.

Replacing Like with Like in Annual Rent Change Readings

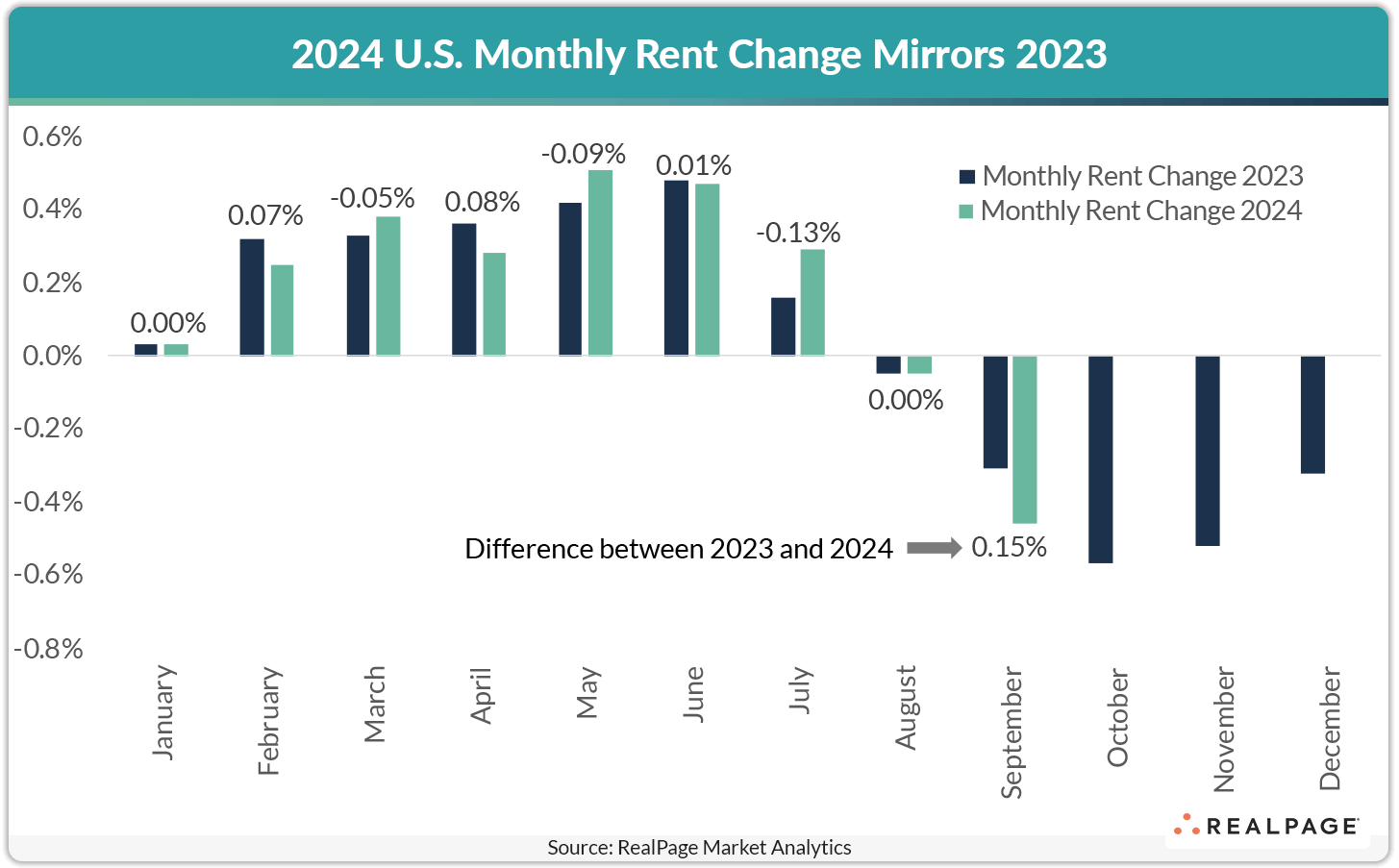

For essentially nine consecutive months, monthly rent change readings have registered within 10 bps of the year-earlier reading. For example, as the August 2023 monthly rent cuts of 0.05% fell out of the annual reading, August 2024’s monthly reading of -0.05% fell into the annual reading, appearing unchanged. This phenomenon has been occurring more or less exactly since January 2024, resulting in an annual rent change reading that looks uniform in year-over-year readings.

Similarly in September, the monthly rent change of -0.46% replaced September 2023’s monthly reading of -0.31%, causing the year-over-year rent change figure to clock in at 0.2%.

Construction Pipeline Emptying Rapidly

While the nationwide supply wave crests, the pipeline of units being built over the next couple years is expected to look quite different. Nearly three-in-four units underway are set to be completed in the next year. Of the nearly 762,000 apartments currently being built in the U.S., about 550,000 units are expected to come online in the year-ending 3rd quarter 2025.

Meanwhile, less than 40,000 units got underway in 3rd quarter 2024, translating to – as it stands right now – fewer than 210,000 units to deliver in 2027. The impact of lowered interest rates will likely bump that rate up as the nation continues to face a housing shortage.