On the back of improved but still muted apartment demand in 2nd quarter 2023, RealPage has downgraded expectations for apartment performance through 2023 and into 2024. Year-to-date rent growth in the U.S. (1.9% through June 2023) clocks in well below the 2010s decade average (3.6%). And that theme is common among most major U.S. markets.

It’s hard to foresee a scenario in which rent growth expands substantially between July and December. The average rent growth rate from July to December in the entire 2010s decade registers at exactly 0.0%. So it would be extremely unexpectedly strong performance in the back half of 2023 if rents change surged beyond its current year-to-date level. In 2022, from July to December rents contracted 0.3%, marking a weaker than typical reading. Given that recent comparison point, 2023 expectations are mild at best.

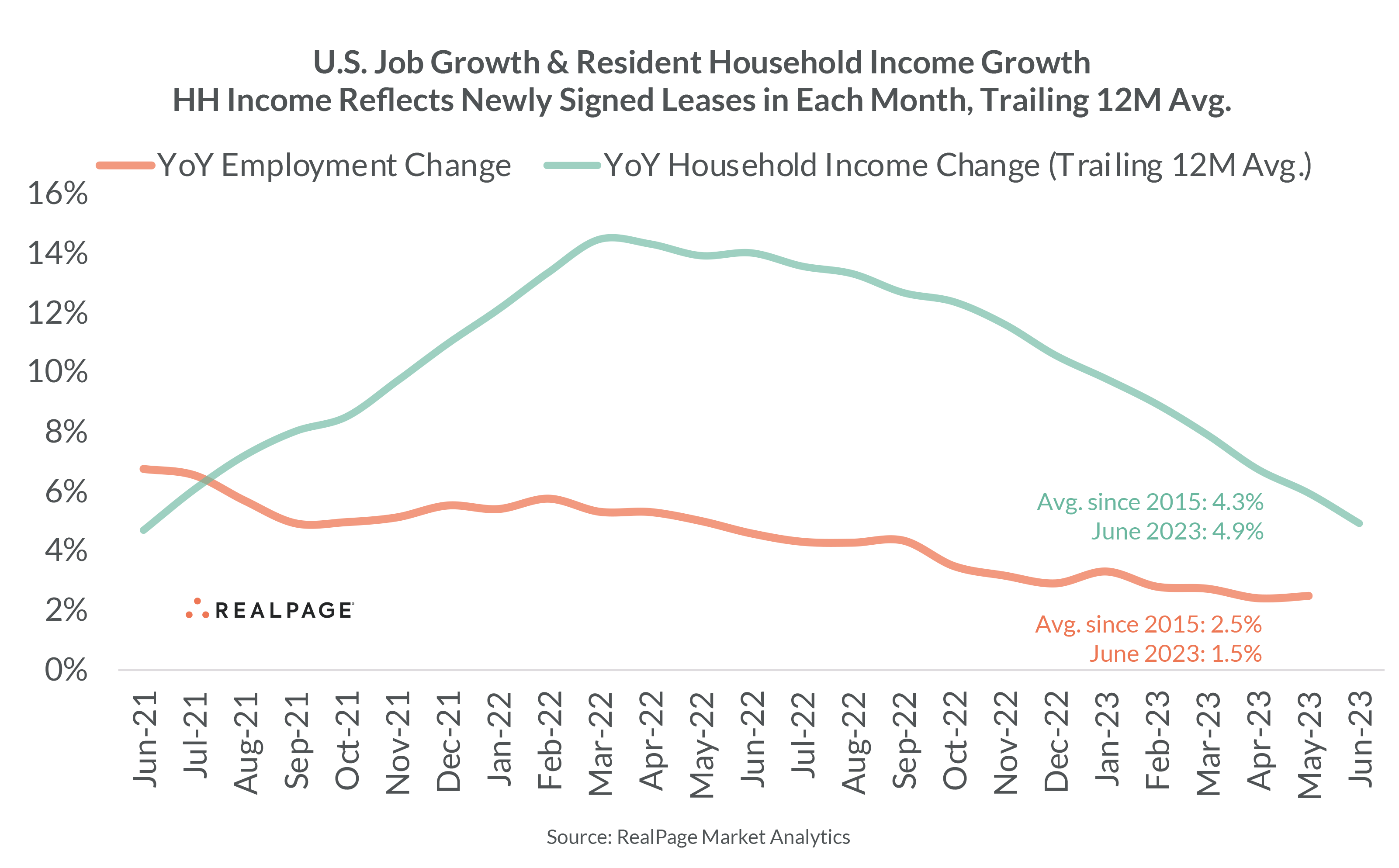

Plus, current challenges to the market will linger into 2024. Robust supply, persistent unknowns from the impact of rising interest rates, slowing job growth and demographic shifts all impact apartment market performance. Therefore, RealPage downgraded its forecast model both quantitatively and qualitatively from prior expectations.

Still, positives remain in the outlook period. Inflation is finally cooling. Labor force participation continues to climb. And wage growth among conventional market-rate renter households continues to match pace with rent growth (thereby keeping median rent-to-income ratios in balance with 2010s norms).

Ultimately, the outlook for the remainder of 2023 and well into 2024 is cautiously conservative. By 2025 however, the impact of rising interest rates should begin to show up in actualized deliveries. Already the challenge(s) stemming from securing construction financing appear to be weighing heavy on new construction starts – even if recent Census permitting figures are potentially misleading.

Regional Snapshot: 2023 & 2024 Forecast Outlook

Midwest: Normal demand and manageable supply

The Midwest region is the one exception to the national story of robust supply and normal demand. Here, demand is quite normal in many ways. And unlike in the rest of the country, the Midwest’s supply pipeline never got quite as full as elsewhere. As such, the balance of supply and demand, rent growth and occupancy rates across many Midwest markets remain among the nation’s strongest.

More than a few Midwest markets will log top quartile performance nationally in the remaining months of 2023. Barring an unforeseen event, the absence of supply pressure coupled with slow-yet-steady demand signals a strong outlook for the nation’s Heartland.

Northeast: General stability with some urban core pressure

Many Northeast markets exhibit Midwest-like qualities. Relatively modest construction coupled with stabilizing demand boosted the outlook of most Northeast markets relative to the national average.

Without acute supply pressure, Northeast markets will likely continue to outperform. One exception should be noted: A few urban cores with robust construction pipelines – such as in Boston, Philadelphia and riverfront Northern New Jersey – will likely lag intermarket suburban areas until supply pressures subside.

South: A wide range of outlooks

The South yields a mixed bag of expected apartment performance in the remainder of 2023 and into 2024. Less flashy markets without acute supply pressure (such as Mid-Atlantic markets like Virginia Beach, Richmond and Baltimore) are forecasted to lead the region in fundamentals.

Meanwhile markets like Dallas/Fort Worth and the South Florida trio boast robust economic growth but potentially limiting supply challenges, likely causing apartment performance to remain a middle-of-the-road performer in the near term.

Perhaps the widest range of potential outcomes belongs to markets with both high supply and high demand, including Charlotte, Raleigh/Durham, Nashville, Tampa and Orlando. Though momentum in Central Florida has cooled substantially recently.

The weakest South region markets in the outlook are those with supply pressure and/or hyperlocal challenges. Jacksonville, Atlanta, Houston and, to a lesser degree, San Antonio could be challenged through the remainder of 2023 and 2024.

West: West region markets lag the U.S. with a few pockets of strength to be found

As of 2nd quarter 2023, only two major West region markets boast annualized rent change above the U.S. norm: San Diego and San Jose. The 2024 outlook in those markets is easily the strongest within the region. San Diego’s stable demand amid modest supply benefits the near-term outlook. San Jose, meanwhile, is capturing a larger share of Bay Area demand as San Francisco suffers lingering demographic shifts from the pandemic.

Orange County (Anaheim) and the Inland Empire (Riverside) boast relatively strong 2024 outlooks within this region, though the Inland Empire outlook appears to be heavily bifurcated between Class A (likely lagging) and Class B (likely leading). Los Angeles, meanwhile, trails the rest of Southern California, especially in supply heavy neighborhoods such as Hollywood, Downtown and Mid-Wilshire.

Tech-heavy markets like Seattle, San Francisco and, to a lesser degree, Portland always feature a wider risk/reward range. Thus far, those markets appear to be bogged down by economic challenges stemming from 2022’s tech market adjustment. Within these metros, expect a discrepancy between urban core (lagging) and suburban (leading) performance.

And last, markets with a severe slowdown in 2022 performance will likely continue to work through challenges in the outlook period. Supply is the number one challenge to Phoenix’s outlook – a market in which nearly every neighborhood is seeing negative annualized rent growth. As such, the outlook for places like Las Vegas, Phoenix and Sacramento is among the nation’s weakest through 2024.